According to Hugh Hendry, China's 'miracle' growth story might come to an end, an ugly one.

During The Russia Forum 2010, he made some stark remarks and nearly got into a fight with Marc Faber.

"I love Jim O'Neill. I love that Goldman Sachs guy. He says you either get it, or you don't. I don't get it. In the future there will be a Confucius saying: the wise man not invest in overcapacity. The flaw of the business model, at the center of it is a craving for power as opposed to profit." His remarks on China starting at 55 minutes into the clip.

Video here.

Who is Hugh Hendry? From FT:

Mr Hendry’s Eclectica Credit Fund is constructed from a portfolio of short positions against highly cyclical Japanese corporate credits that have high exposure to Chinese demand.

The fund, which raised a modest $150m from a handful of London investors when it launched late last year, is up 38.65 per cent so far this year, having returned 22.5 per cent in August – the hedge fund industry’s worst month since the collapse of Lehman Brothers three years ago.

The news comes as concerns of a Chinese slowdown gather speed. Wu Xiaoling, the former deputy central bank governor and vice director of the finance and economy committee of the National People’s Congress, said the economy would cool next year and efforts to spur growth would be constrained by inflation, in an article published on Monday by the Chinese central bank’s official newspaper.

Mr Hendry’s fund is up a further 11 per cent for September, according to an investor. Mr Hendry declined to comment.

In comparison, the average hedge fund has lost money this year, data from Hedge Fund Research show. The HFRI composite index, which tracks performance numbers from across the industry, is down 1.47 per cent since January.

Mr Hendry, a noted contrarian, began raising concerns about a Chinese slowdown in 2009 – even uploading a homemade video on to the popular video sharing site YouTube based on a visit to deserted Chinese real estate developments.

Tuesday, September 20, 2011

Friday, April 8, 2011

Monday, March 28, 2011

Tuesday, March 22, 2011

What we are facing.

The development in the US and Japan is not going well. How is that? Read through the two articles.

US: The coming crisis in the US and how we should protect ourselves

Japan: The rising sun is, indeed, falling

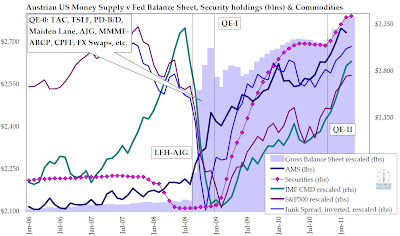

And finally, to sum it up, I present here an interesting graph:

US: The coming crisis in the US and how we should protect ourselves

Japan: The rising sun is, indeed, falling

And finally, to sum it up, I present here an interesting graph:

Wednesday, January 5, 2011

Gold trend

RSI and the price of gold shows 4 waves divergence, i.e. gold price has four peaks, one higher than the previous one (except the last one), while RSI also has 4 peaks, but one lower than the previous one. This is a very strong signal of an adjustment of gold price.

But the adjustment might just provides us a good opportunity to buy gold. It seems that gold still has a long way to reach its peak. The current international monetary system that uses the US dollar as the major anchor is breaking down. Confidence in the US dollar is weakening around the globe. That's why we have witnessed price surge in commodities. Before we reach a new international monetary system, gold will protect us from currencies devaluation and the coming inflation.

But the adjustment might just provides us a good opportunity to buy gold. It seems that gold still has a long way to reach its peak. The current international monetary system that uses the US dollar as the major anchor is breaking down. Confidence in the US dollar is weakening around the globe. That's why we have witnessed price surge in commodities. Before we reach a new international monetary system, gold will protect us from currencies devaluation and the coming inflation.

Tuesday, January 4, 2011

Subscribe to:

Posts (Atom)